The Executive Board of the International Monetary Fund (IMF) approved a new 3-year arrangement under the Extended Credit Facility (ECF) for Somalia in an amount of SDR 75 million (about 45.9 percent of quota, about US$100 million).

Approval of the ECF arrangement enables immediate disbursement of SDR 30 million for budget support (about US$40 million). This follows the successful completion of a previous ECF arrangement approved in 2020 and that expired on December 15, 2023. The Executive Board’s decision to approve the new program was taken on a lapse of time basis, following Board discussion of the authorities’ program request on December 13, 2023.

Achievement of the HIPC Completion Point and completion of the 2020 ECF is a testament to the Somali authorities’ sustained track record of reform implementation over the past years, despite numerous challenges. Though these efforts, Somalia has made considerable progress in strengthening key economic and financial institutions, as well as improving governance.

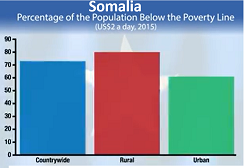

However, despite the progress achieved, Somalia faces significant challenges, including those stemming from economic, social, security, and climate risks. In 2022, an estimated 54 percent of the population was living on less than US$ 2 per day. Growth is currently insufficient to reduce widespread poverty, address large social needs, and create sufficient jobs for the youth. Somalia is highly vulnerable to climate shocks that hurt growth and hinder poverty reduction efforts.

Faced with these challenges, the authorities are embarking on a new 3-year IMF-supported program. The program will support the authorities’ post-HIPC reform strategy to further strengthen key economic institutions and promote macroeconomic stability and growth, in line with Somalia’s national development plan and the government’s long-term vision. Reform implementation will be accompanied by extensive IMF capacity development assistance, supported by the Somalia Country Fund.

Fiscal policy will be guided by a prudent framework that balances the need for higher development expenditure with protecting fiscal sustainability and taking into account capacity constraints. External financing is expected to be based solely on grants and concessional loans to preserve debt sustainability.

Increasing domestic revenues is a key pillar of the reform strategy, including implementation of a new income tax law. Efforts to improve public financial management include further progress on payroll integration, expenditure controls, and fiscal transparency, as well as strengthening debt management capacity and public investment management capacity.

Continued improvements in the institutional capacity of the Central Bank of Somalia, including in the context of the currency reform, will foster financial deepening and financial inclusion. It will also be important to continue to advance reforms to improve AML/CFT and governance to promote private investment.